In the vast realm of investment strategies, one philosophy has stood the test of time and proven its worth: The Motley Fool Investing Philosophy. More than just a strategy, it’s a way of thinking, a guiding light that has illuminated the paths of countless investors on their journey to financial success. Let’s delve into this philosophy, uncovering its key principles and discovering how it can truly illuminate your financial future.

A Holistic Approach to Investing

The Motley Fool’s Investing Philosophy isn’t confined to numbers and charts; it’s a holistic approach that takes into account the broader picture. It emphasizes the importance of understanding the companies you invest in, the industries they operate in, and the trends that shape their future. This broader perspective equips you with the knowledge needed to make informed decisions rather than relying solely on market sentiment.

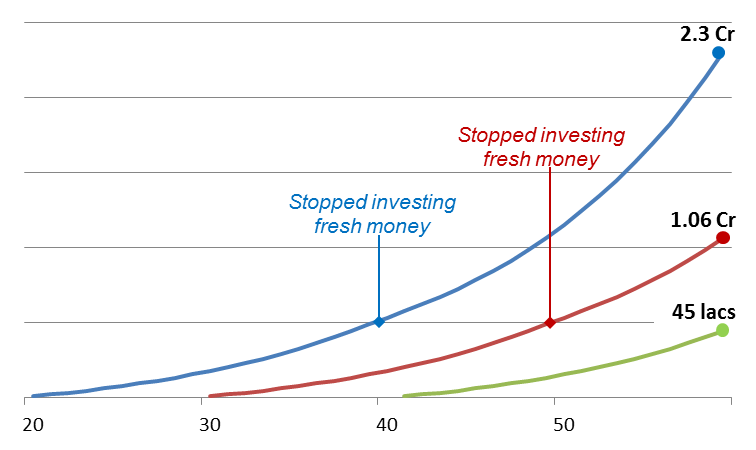

Long-Term Vision: The Magic of Compounding

=> Click here Motley Fool: Investing Philosophy

At the heart of this philosophy lies the concept of long-term vision. The Motley Fool believes in the magic of compounding—the idea that small, consistent gains can snowball into substantial wealth over time. By focusing on companies with strong growth potential and holding onto your investments through market ups and downs, you harness the power of time to work in your favor.

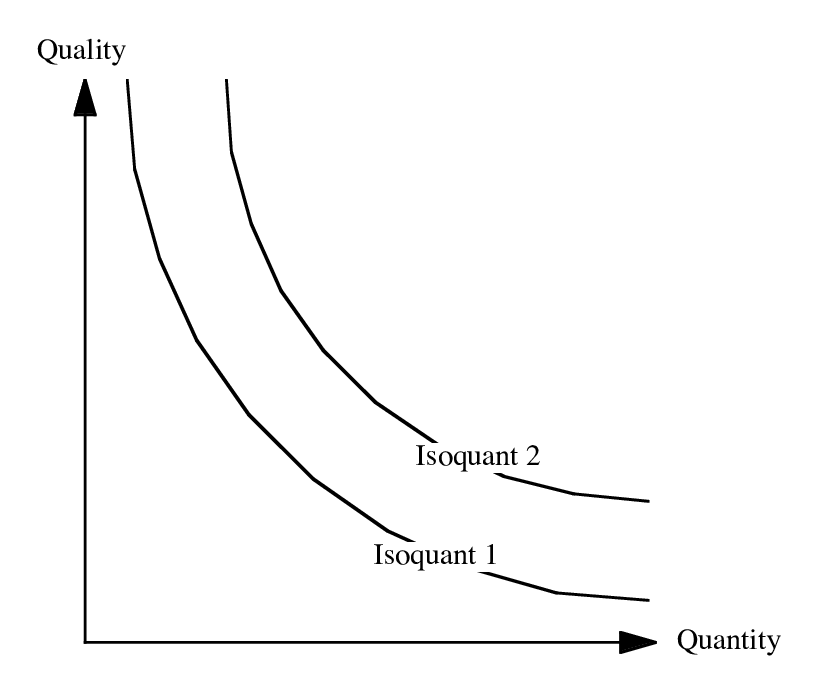

Quality Over Quantity: Diligent Research

=> Click here Motley Fool: Investing in the Financial Diligent Research

The Motley Fool’s Investing Philosophy prioritizes quality over quantity. It’s not about making a multitude of trades; it’s about making well-researched, informed decisions. This philosophy encourages investors to thoroughly examine the fundamentals of the companies they invest in. From financial statements to competitive advantages, every aspect is scrutinized to ensure that your investments have a solid foundation.

Contrarianism and Courage

=> Click here Motley Fool: Investing in the Financial Potential

In a world where herd mentality often prevails, The Motley Fool dares to be different. The philosophy embraces contrarianism—the idea of going against the crowd. This takes courage, but it’s often where the most significant opportunities lie. By identifying undervalued stocks that others may overlook, you position yourself to benefit from market inefficiencies.

Investing, Not Speculating

The Motley Fool makes a clear distinction between investing and speculating. While speculation involves short-term bets driven by emotions, investing is a disciplined process backed by research and analysis. This philosophy encourages investors to think like business owners rather than gamblers, fostering a sense of responsibility and a long-term perspective.

One of the cornerstones of The Motley Fool’s approach is education. They believe that every investor should be empowered with the knowledge needed to make sound financial decisions. Through insightful analysis, educational content, and a thriving community, The Motley Fool creates an environment where investors can learn, grow, and take control of their financial future.

Unlocking Your Financial Potential

=> Click here Motley Fool: Investing in the Financial Potential

The Motley Fool’s Investing Philosophy isn’t just a strategy; it’s a mindset that has the potential to reshape your financial future. By embracing a holistic approach, nurturing a long-term vision, conducting diligent research, and having the courage to think differently, you set yourself on a path to financial independence and success. Illuminating your financial future isn’t just a dream; with The Motley Fool, it’s a tangible reality waiting to be unlocked

=> Click here Motley Fool: Investing in the Financial Future