How to Send Money Abroad Safely and Conveniently with Wise Money without borders

Are you looking for a convenient way to send money abroad safely? Look no further than Wise Money without Borders. Wise is an international account that makes sending money abroad easy and secure. With Wise Money without Borders, you can save time and money when transferring funds internationally. This blog post will provide an overview of how to use Wise Money without Borders to transfer money securely and conveniently.

What is Wise and how does it work?

Wise is a financial technology company that allows people to send and receive money internationally without high fees or hidden costs. Wise offers an international account that allows users to hold money in multiple currencies, as well as a debit card that can be used worldwide.

Wise works by using peer-to-peer technology, which means that transfers are made directly between users’ bank accounts. This eliminates the need for intermediary banks, which can add additional fees and delays to the process.

When someone sends money through Wise, they simply input the recipient’s bank details and the amount they want to send. Wise then converts the funds into the recipient’s local currency at the real exchange rate, which is the same rate you see on Google or Reuters. This ensures that the recipient receives the most accurate and fair exchange rate possible.

Overall, Wise provides a convenient and affordable way for people to send and receive money internationally, making it an excellent choice for anyone who needs to transfer money across borders.

The benefits of using Wise for international money transfers

If you frequently send money to family and friends overseas or make international business payments, using Wise can provide you with numerous benefits. With a Wise international account, you can easily transfer money across borders without the high fees and hidden charges associated with traditional banks. Here are some of the key benefits of using Wise for your international money transfers:

- Low fees: Unlike traditional banks, Wise charges a low and transparent fee for each transaction. This can save you a lot of money in fees, especially if you are transferring large amounts of money.

- Competitive exchange rates: Wise offers highly competitive exchange rates, which means you get more value for your money when you transfer funds. This is because Wise uses the real mid-market exchange rate, which is the rate that banks use when they trade currencies with each other.

- Fast transfers: Wise transfers are usually processed within hours, which means you can send money to your loved ones or business partners quickly and easily.

- Easy setup: Setting up a Wise account is a straightforward process that takes just a few minutes. You can do it from your smartphone or computer, and you don’t need to visit a bank or fill out any complicated forms.

- Multiple currency options: With a Wise account, you can hold and send money in multiple currencies, which makes it convenient for you to manage your finances and send money to different countries.

- Safe and secure: Wise uses the latest security technology to keep your money and personal information safe. Your account is protected with two-factor authentication and encryption, and Wise is regulated by the Financial Conduct Authority (FCA) in the UK.

Overall, using Wise for your international money transfers can provide you with a cost-effective, convenient, and secure way to send money overseas.

Setting up a Wise account is simple. Here are the steps to follow:

- Go to the Wise website and click on the “Sign up” button.

- Enter your email address and create a strong password.

- Provide your personal details, such as your name and address.

- Verify your identity by uploading a copy of your ID or passport.

- Choose the currencies you will be using for your transfers.

- Add your bank account or debit card details.

- Verify your bank account or debit card by making a small payment.

- Start sending and receiving money with Wise.

It’s important to note that Wise supports multiple account types, including personal and business accounts. Additionally, Wise is available in over 80 countries and supports over 50 currencies, making it a versatile option for international money transfers.

How to send money abroad with Wise step-by-step

- Set up your Wise account by creating an account on their website or downloading the app on your mobile device.

- Once you’re signed in, click “Send Money” on the homepage.

- Enter the recipient’s name and email address.

- Select the currency you want to send and the amount you want to transfer.

- Review the fees and exchange rates before confirming the transfer.

- If you’re happy with the details, click “Confirm and Continue.”

- Choose how you want to pay for the transfer (bank transfer, debit card, or credit card).

- If you’re paying with a debit or credit card, you’ll need to enter the card details.

- Finally, confirm the transfer and wait for the funds to be sent to your recipient.

It’s worth noting that the exact steps may vary depending on the country you’re sending money from and the currency you’re sending. However, the process is generally very straightforward and user-friendly. Plus, Wise will keep you updated every step of the way with notifications and alerts.

Wise fees and exchange rates explained

When it comes to sending money abroad, one of the biggest concerns for many people is the cost. This is where Wise comes in. Wise offers competitive fees and exchange rates for international transfers, making it a popular choice among those looking to send money without breaking the bank.

Wise charges a small percentage fee on each transaction, which is generally much lower than what traditional banks and money transfer services charge. This fee varies depending on the currency you are sending and the amount of money you are transferring. However, Wise is transparent about its fees, so you will always know how much you will be charged before you confirm your transfer.

In addition to low fees, Wise also offers great exchange rates. When you transfer money with Wise, you can expect to get the real, mid-market exchange rate – the rate at which banks and financial institutions trade currency with each other. This means you get a fair and transparent exchange rate, without any hidden markups or fees.

It’s important to note that Wise also offers a currency conversion feature that allows you to hold money in different currencies, which can save you money on currency exchange fees if you are frequently transferring money between different countries.

Overall, using Wise for international transfers is an affordable and convenient option that offers competitive fees and great exchange rates. Whether you are sending money to friends or family, paying for a service or product overseas, or simply managing your finances across borders, Wise is a reliable and trustworthy solution.

Wise security features and safety measures

One of the biggest concerns people have when it comes to sending money internationally is security. Fortunately, Wise has taken numerous steps to ensure that your transactions are safe and secure.

Firstly, Wise is fully licensed and regulated by financial authorities in multiple countries. This means that they are required to follow strict regulations and guidelines to operate. Additionally, Wise uses top-notch security technology, such as 256-bit SSL encryption, to protect your data.

Furthermore, Wise uses a multi-factor authentication process to verify your identity when you sign up for an account and whenever you make a transaction. This means that even if someone were to steal your login credentials, they wouldn’t be able to access your account or make any transactions without the additional authentication.

Wise also has a dedicated security team that monitors their systems 24/7 to detect any suspicious activity. If any issues are identified, they will take immediate action to resolve them and ensure that your account and money are safe.

In terms of safety measures, Wise keeps your money in separate bank accounts to ensure that it is never mixed with their own funds. This means that in the unlikely event that something were to happen to Wise, your money would still be safe and protected.

Overall, Wise takes security and safety very seriously and has implemented numerous measures to ensure that your money and data are protected. With Wise, you can send money abroad with peace of mind knowing that your transactions are secure.

Wise customer support and user reviews

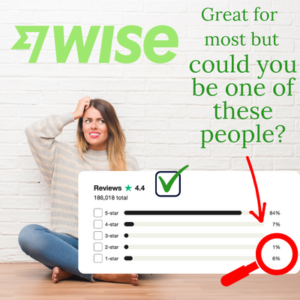

Customer support is a critical factor in any financial service, especially when it comes to international money transfers. Wise has a dedicated customer support team that is available to help you with any issues or questions you may have.

You can contact Wise’s customer support team via phone, email, or chat, and they are available 24/7 to assist you. Their response time is quick, and their support staff is knowledgeable and helpful.

In terms of user reviews, Wise has a 4.5-star rating on Trustpilot, with over 130,000 reviews. Customers rave about the convenience and transparency of using Wise for international money transfers. Many users praise Wise for its fast transaction times, excellent exchange rates, and low fees.

Users also appreciate Wise’s commitment to transparency and its efforts to reduce hidden fees. Wise provides a detailed breakdown of its fees and exchange rates upfront, so you know exactly what you’ll be paying before you make your transfer.

Overall, Wise has a strong reputation among its users, and its customer support team is there to ensure that your international money transfers go smoothly. If you’re looking for a reliable and convenient way to send money abroad, Wise is definitely worth considering.